|

|

|||

|

||||

| Web Sites, Documents and Articles >> Hartford Courant News Articles > | ||

|

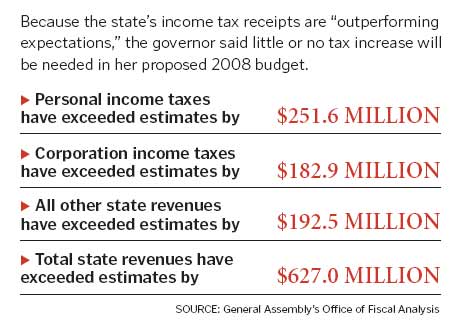

Rell Reconsiders Tax Hike May 10, 2007 In a stunning turnaround, Gov. M. Jodi Rell said Wednesday that state tax revenue is so robust that the legislature can pass a budget this year with little or no tax increase.

Rell told reporters that she is considering dropping her proposed income tax increase, which has been heavily criticized by Republicans and fared poorly in a poll released Wednesday by Quinnipiac University. Only 16 percent of those surveyed said they supported Rell's original plan to increase the state income tax by 10 percent over the next two years. A key Democrat reacted by saying the legislature might increase the popular property tax credit even beyond the maximum amount of $1,000 that Democrats have proposed. Rep. Cameron Staples of New Haven, who is co-chairman of the tax-writing finance committee, said lawmakers were still analyzing the numbers to determine the exact amount of the credit. The current maximum credit is $500 annually for couples earning less than $100,000, and the credit drops in phases for those earning above that level. "It may enable us to provide more property tax relief," Staples said. "We're looking at other forms of providing relief to lower- and middle-income taxpayers." But Staples said the increased tax revenue still would not balance the $17.79 billion budget that the Democrats have proposed for the next fiscal year. That proposed plan is 10.4 percent higher than the current budget. "The numbers are good, but they still wouldn't cover the education and health care and property tax proposals the Democrats want to see in the budget," said Staples. "Our budget isn't the same as the governor's. Her budget included nothing for health care. That's a priority of the Democratic budget to address the health care needs of the hospitals, the providers and the citizens. That's just one item that her budget doesn't address that we think is important. ... We still have our priorities." The news flew around the state Capitol as legislators immediately said the new money would make reaching a budget compromise much easier. Lawmakers have been meeting behind closed doors in an attempt to reach an agreement before the legislature's scheduled adjournment June 6. Rell made her statements about taxes in an impromptu news conference in her Capitol office after she introduced New York City resident Joan McDonald, 51, as the state's new commissioner for the Department of Economic and Community Development. Rather than making an announcement, Rell talked about the budget only after being asked by reporters. "We could pass my budget with very little or no tax increase," Rell said. "The appropriations budget [by Democrats who control the legislature] is $2 billion more than mine. There is no way that that budget would be passed with that scenario." Rell's budget would still include her $3.4 billion education plan over the next five years, even though the legislature would be voting on the funding only for the first two years in the two-year budget. Under Rell's original plan to raise the income tax from 5 percent to 5.5 percent over two years, the state would have collected an additional $1.2 billion over two years. Rell has remained relatively silent on Democratic lawmakers' plan to increase the state income tax to a maximum of 6.95 percent on income above $250,000 per year, up from the current maximum rate of 5 percent. But the new statistics prompted Rell to criticize the Democratic plan. "With these new numbers, I think it's way out of whack, and it's way too much in taxes," Rell said. But Senate President Pro Tem Donald Williams, the highest-ranking senator, said Rell has still not proposed the same type of cuts in the income tax that Democrats are pushing for lower- and middle-income taxpayers. "If she is going to repudiate her tax increases, then she is going to have to repudiate her spending increases," Williams, D-Brooklyn, said Wednesday night. "It doesn't add up. They've had significant buyer's remorse pertaining to their own budget and tax plan. They're very good at being able to measure the political winds." The increased tax collections come at a time when the Connecticut economy is stronger than some insiders had predicted. Rell is touting five consecutive months of job growth and one of the strongest quarters in state history for job growth. If the economy continues at its current pace, state officials believe the state can break its all-time record of 1.7 million jobs reached in the prosperous days of July 2000. The state's unemployment rate in March was 4.1 percent, which was better than the national rate of 4.4 percent. With low unemployment, more workers are contributing to state coffers through withholding taxes. At the same time, Wall Street has been booming, and wealthy investors have been paying capital gains taxes as part of the state income tax. "This is based on real data," Rell's budget director, Robert Genuario, said of the projections. "The data that came in on April 15 indicates a healthier economic climate than we were able to project back in February when the governor put her education plan together." House Speaker James Amann, however, said he is not satisfied to simply end the year with no tax increase. "We don't want to keep the status quo," the Milford Democrat said Wednesday. "With this new money, we can give more tax relief for the taxpayers. Let's give even more tax relief to more and more citizens." Amann, who has clashed often with Rell over the budget and taxes, said he was not surprised that she is strongly considering dropping her income tax plan. "It doesn't shock me," Amann said. "Why did the governor ever come up with an across-the-board tax increase, blowing through the [spending] cap? The governor shouldn't be governing by polls." But House Republican leader Lawrence Cafero of Norwalk pointed to Wednesday's Quinnipiac poll, which showed that only 33 percent favored the Democratic tax plan. "The numbers don't lie," Cafero said. "No one believes the Democrats when they claim they will give you a big tax cut because you cannot increase spending by $2 billion and tell everyone their taxes are going down. They are not being honest." The problem, Cafero said, is that the Democratic plan calls for increasing the sales tax on clothing under $50, on funeral expenses and on sales made over the Internet. Cafero, Senate GOP leader Louis DeLuca of Woodbury, and deputy Senate GOP leader John McKinney of Fairfield all touted the poll that said that 41 percent favored the Republicans' no-tax increase plan. "The public does not want to see their taxes go up," Cafero said, "and they have made that clear. We can get out of this session without either version of the tax increases."

|

||

| Last update:

September 25, 2012 |

|

||

|